Safe Cryptos to Invest In: Your Complete Guide

The world of cryptocurrency is a fascinating and rapidly evolving landscape, attracting individuals and corporations alike to explore the vast opportunities it presents. However, with the plethora of options available, identifying safe cryptos to invest in can be quite daunting. This comprehensive guide will explore various factors influencing safe investments in cryptocurrencies, highlighting specific cryptos that have demonstrated stability and resilience throughout their existence.

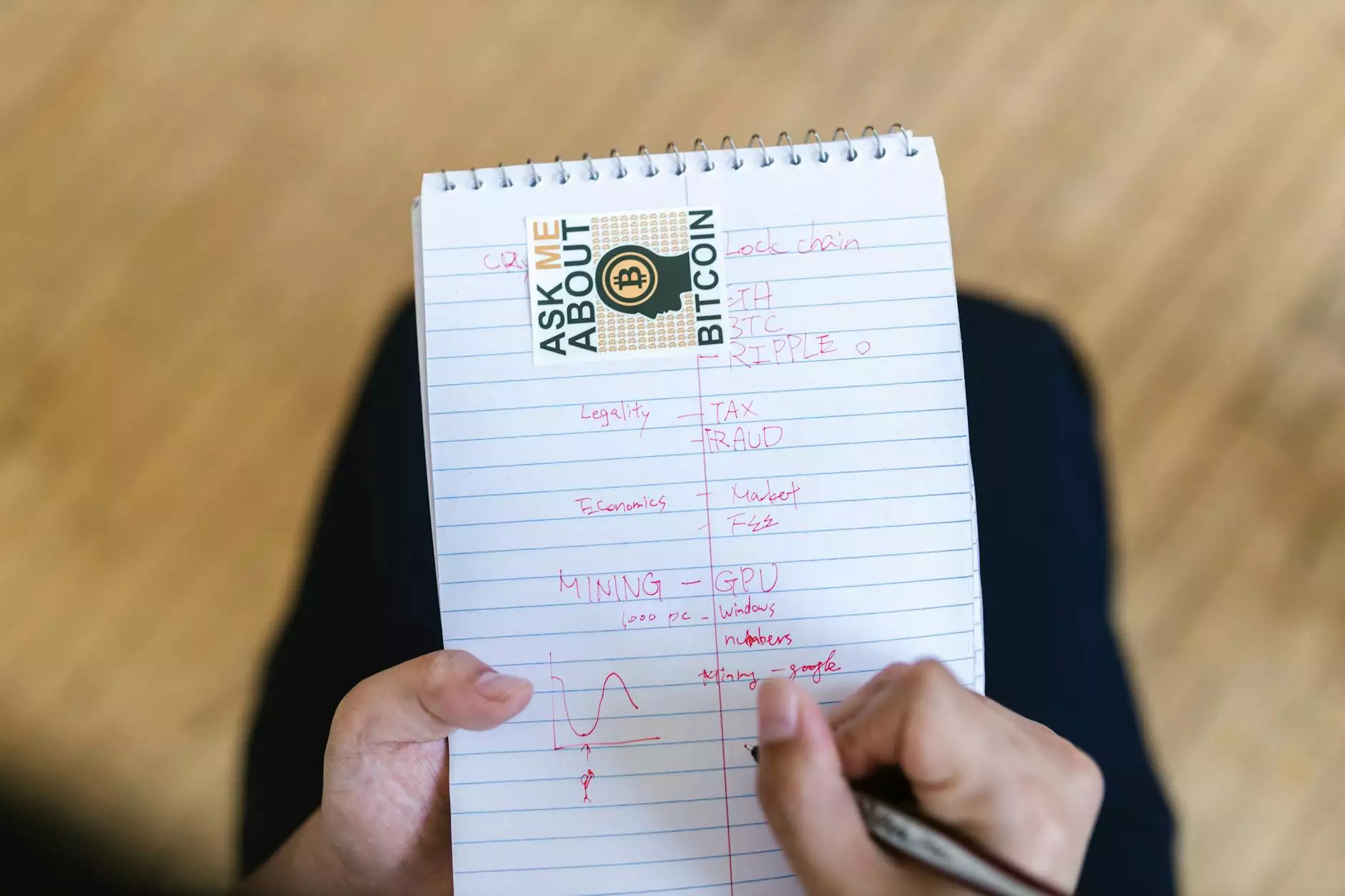

Understanding the Cryptocurrency Market

Before diving into specific cryptocurrencies, it’s fundamental to understand the mechanics of the crypto market. Unlike traditional investments, the cryptocurrency market operates 24/7, with a high degree of volatility. Thus, potential investors must undertake diligent research and analysis before committing their funds. This includes understanding market caps, trading volumes, technological developments, and community support for each coin.

The Importance of Safety in Cryptocurrency Investments

Safety is a paramount concern for any investor. Investing in cryptocurrencies involves unique risks, including but not limited to market volatility, regulatory changes, and potential security issues such as hacks. Therefore, it's critical to choose well-established cryptocurrencies, backed by solid technology and a loyal user base. When assessing safe cryptos to invest in, consider the following criteria:

- Market Capitalization: Higher market caps generally indicate established coins with a lower risk of failure.

- Technology and Use Case: Cryptocurrencies with superior technology and practical use cases tend to be more resilient.

- Community and Development: A strong community and continuous development improve a cryptocurrency's prospects.

- Regulation: Coins that comply with regulatory requirements tend to be safer investments.

Top Safe Cryptos to Invest In

Now that we’ve established the importance of safety and the criteria to evaluate cryptocurrencies, let’s delve into some of the most promising options for investors in 2023.

1. Bitcoin (BTC)

As the original cryptocurrency, Bitcoin remains the gold standard in the industry. With a market cap exceeding $500 billion, Bitcoin is the most recognized and widely adopted cryptocurrency. Its scarcity, capped at 21 million coins, combined with its decentralized nature, positions it as a safe investment. Bitcoin has proven its resilience through numerous market downturns, maintaining its status as the leading cryptocurrency.

2. Ethereum (ETH)

Second only to Bitcoin, Ethereum is renowned for introducing smart contracts, allowing developers to build decentralized applications (dApps) on its blockchain. Its ongoing upgrades to Ethereum 2.0, aimed at improving scalability and security, increase its attractiveness as a long-term investment. With a market cap of over $200 billion, Ethereum is one of the safest cryptos to invest in due to its robust technology and extensive developer community.

3. Binance Coin (BNB)

Initially created as a utility token for the Binance exchange, Binance Coin has evolved into one of the leading cryptocurrencies. With its use cases growing beyond just trading fees, BNB has become integral to Binance Smart Chain (BSC) projects. Its significant market presence and strong use cases make it a promising option for investors seeking safety and growth.

4. Cardano (ADA)

Cardano is often hailed for its academic and research-driven approach to blockchain technology, emphasizing security and sustainability. With a market cap of approximately $12 billion, Cardano’s focus on scalability and real-world use cases positions it as a safe investment, particularly as it gains traction in various sectors such as finance and education.

5. Solana (SOL)

Solana has gained immense popularity for its high throughput and low transaction costs, making it a strong competitor to Ethereum. Its growing ecosystem of DeFi and NFT projects supports the long-term viability of Solana, making it a safe crypto investment to consider. With ongoing developments and significant partnerships, Solana’s potential continues to expand.

Factors to Consider When Choosing Safe Cryptos

Selecting a safe cryptocurrency extends beyond merely picking well-known names. Here are additional factors to consider:

Diversification

Don’t put all your eggs in one basket. Investing in a variety of cryptocurrencies can help mitigate risks associated with individual asset fluctuations. Diversification allows investors to capture potential growth across different sectors of the crypto market.

Research and Due Diligence

Investors should conduct thorough research on any cryptocurrency they’re considering. Look for transparency in team composition, technology, partnerships, and community involvement. Due diligence is key to securing your investments against unforeseen risks.

Security and Storage

Once you've identified the safest cryptocurrencies to invest in, ensure that you secure your assets properly. Utilize hardware wallets for long-term storage, keep your software wallets updated, and enable two-factor authentication where possible to safeguard your investments from hacks and fraud.

Staying Informed in the Crypto Space

The cryptocurrency market is highly dynamic, with new developments occurring daily. Staying informed is crucial for maintaining a successful investment strategy. Consider the following tips:

- Follow Industry News: Regularly read reputable crypto news outlets and forums to stay up to date.

- Join Online Communities: Engage with online communities on platforms like Reddit, Telegram, and Twitter for real-time discussions and insights.

- Attend Virtual Conferences: Participate in webinars and conferences to learn from industry experts and gain unique perspectives.

The Future of Cryptocurrencies

As we progress into 2023 and beyond, the future of cryptocurrencies looks promising. With blockchain technology innovations, institutional adoption, and regulatory clarity on the horizon, opportunities for investors will continue to grow. The key to successful investing lies in making informed decisions, focusing on safe cryptos to invest in, and being prepared for the inherent risks of this volatile market.

Conclusion

In conclusion, navigating the world of cryptocurrencies requires a blend of caution, research, and strategy. By focusing on fundamentals like market capitalization, technological advancements, and community engagement, you can identify safe cryptos to invest in that align with your financial goals. Remember, successful investing is as much about timing and market conditions as it is about understanding the assets you choose. Equip yourself with knowledge, stay informed, and make educated decisions to maximize your investment potential in the exciting world of cryptocurrencies.

The keys to thriving in this evolving landscape are knowledge, safety, and diversification. Embrace the journey with confidence, and you may find the rewards well worth the effort.